A default under this section refers to loans that:

Here we look at the number of loans that we have taken through the mortgagee sale process and have been sold, some perhaps resulting in a loss (or ‘write off’) of funds to the lender (and therefore our investors). These amounts are aggregated from 1 December 2016 to date.

We look at two key measurements:

Gross value of default loans, potential loan write off - $1,531,437.51

over 2 loans (with such number of loans representing less than 1% of our total loans).

Gross value of loans is the total value of all loans where we have sold the asset(s) through the mortgagee sale process. This is the loan amount owed at the time of sale, including the associated mortgagee and legal costs.

Net value of actual loans written off (loss to the investors) - $0

over 1 loan

Net value of loans is calculated by taking the gross value of write off loans (as above) minus the proceeds recovered from the sale of the asset(s). This amount is what the loss was to investors after enforcement action against the applicable Borrowers was completed.

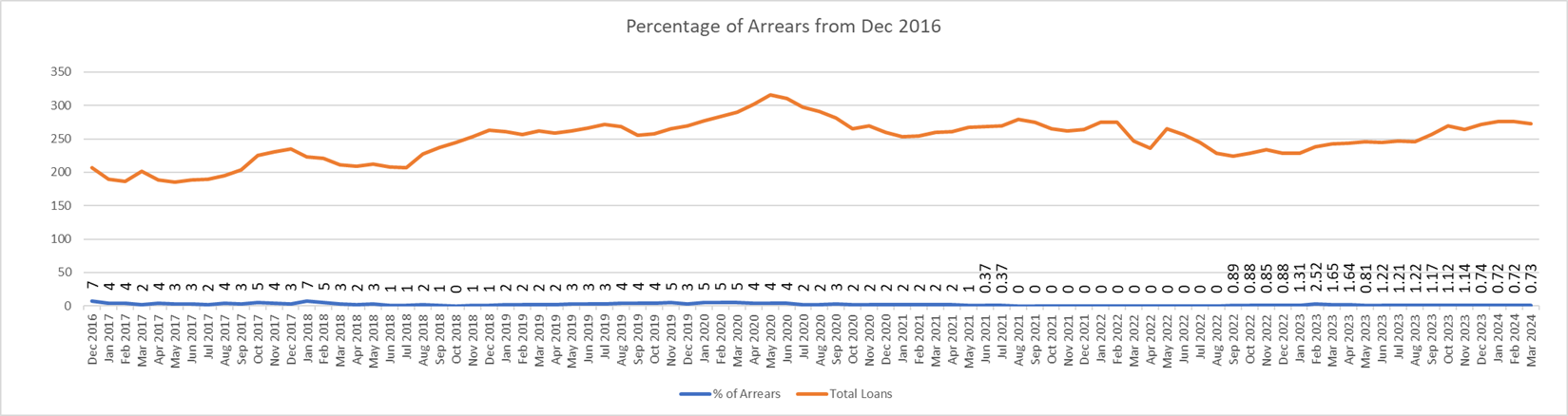

A default under this section refers to when the borrower is behind on payments or repayment of their loan, and we record this loan as still being owed to Southern Cross Partners (and therefore our investors).

Southern Cross Partners has two key measurements default on loan performance by borrowers.

1. Arrears

This measurement looks at the number of unexpired loans that we manage that have payments that are in arrears for 30 days or more.

We focus on the 30 day arrears period as this is the trigger point that we use to advise Investors of potential problems with Borrowers. It is also because it is not unusual for loan payments to be slightly delayed due to payments falling due on weekends, or for borrowers to catch up missed payments over the following few weeks.

Due to the large variances in loan sizes (which can regularly skew percentages), our percentage is calculated on the number of total loans, as opposed to a dollar value.

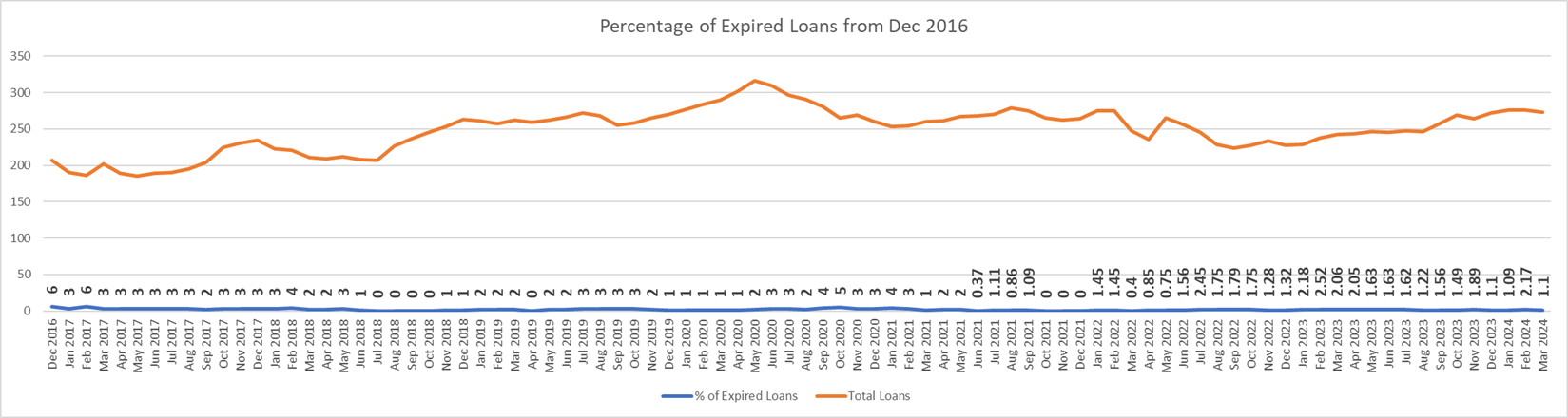

2. Expired loans

This measurement looks at the number of loans that are beyond their maturity date by 30 days or more.

We focus on the 30 day period as it is not unusual for arrangements to be made to repay loans slightly after maturity. Again, our percentage is calculated on numbers of total loans rather than dollar values.

These figures are updated monthly and are reported as at the 1st of each month:

Please note that this is historical information and is not necessarily any indication of what percentage of loans in the future may default or expire.

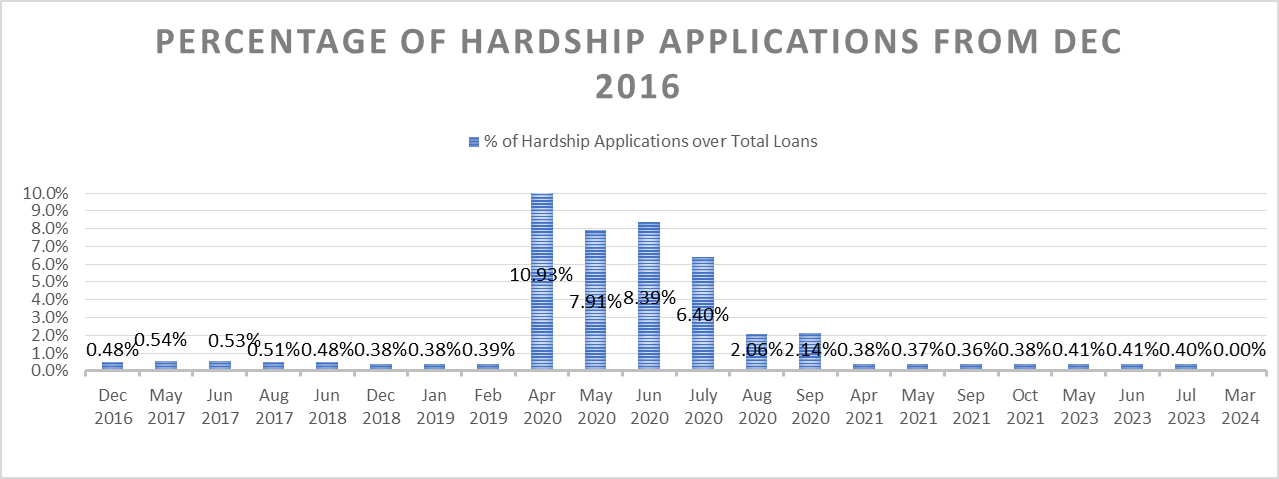

3. Hardship

Borrowers, under loans which constitute consumer credit contracts (or regulated loans), do have a legal right to make application for Hardship relief if they are suffering from some unforeseen event. If this application is accepted by us, it may result in an extension to the loan term and/or a suspension of interest payments. This, of course, does impact on your investment, with either your payments affected and/or your investment term extended. If interest payments are affected, these will all be made up, to the extent possible, from payments received from a borrower, at a later, agreed date. Loans are not deemed to be in default while a hardship arrangement is in place.

Please note that this Hardship provision is available to Borrowers as a legal right. We are not obliged to agree or to alter loan terms, although we must comply with lender responsibility principles when making our decision. Borrowers have rights of higher appeal if they believe that they are not being fairly treated by us.

The number of loans managed by Southern Cross Partners Limited and subject to approved Hardship relief is: